2 Models Operating In Takaful Business

Takaful Models There are various models adopted in different Muslim countries the one model is Mudarabah Model which describes that all policyholders must agree to share profits or losses from the undertaking Maysami et al 1997. In summary this model is neither appropriate not shareholder friendly to set up takaful except for the application on investment profit sharing.

The Wakala Model In Takaful Insurance Download Scientific Diagram

Mudharaba model There is no unique operating model for takaful companies as each country has its preferred model.

2 models operating in takaful business. Al-Wakalah is a fee-based model in which the TO earns fee for the service of running the operation. Determinants of Islamic Insurance Acceptance. Takaful - Wakalah Model.

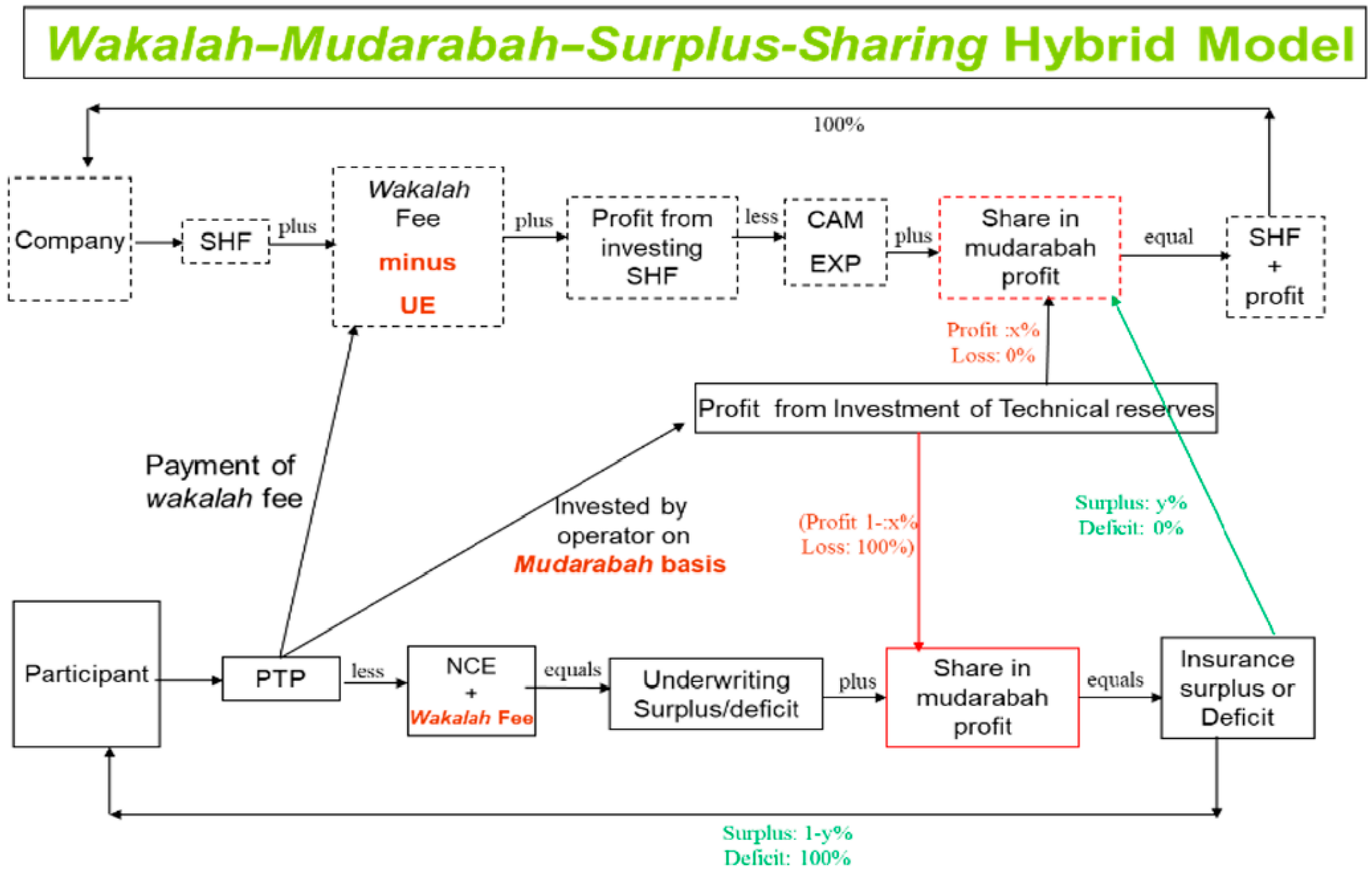

Wakala is an agency system where takaful operator being an agent is appointed by participant principal to act on latters behalf in exchange of Wakala fee. This is the beauty of Islam itself where of this system is considered more practical than conventional insurance not permissible in Islam. The net funds underwriting surplus will be used for investments and the profits will be distributed accordingly.

Under this model the operators do not have to pay a commission but will receive a salary which will be. Takaful Mudarabah Model. Takaful is a co-operative system of reimbursement or repayment in case of loss organized as an Islamic or sharia compliant alternative to conventional insurance which contains riba and gharar.

The contract will define the profit of the takaful business and the ratio to be shared between. There are basically two different types of Takaful models for the management and investment of funds by a Takaful operator namely the Mudarabah model and the Wakalah model. Takaful across the globe have different model which were developed and approved by renowned Shariah scholars that suits to their country balancing the shareholders and policyholders role and rewards to.

Shariah-Compliant Models for the Deposit Insurance System. There are wakalah agency mudarabah and a combination of the two. It has adopted the Wakalah contract as its business model.

The investigation of the volatility patterns and the dependence between the conventional and. In 2018 the takaful. In this model the expenses such as agents salary will be deducted upfront from the Takaful pool of funds.

In the Sudanese takaful model every policyholder is a shareholder in it. Insurance Companies Takaful OperatorsSyarikat Insurans Pengendali Takaful. Under this arrangement a profit sharing contract is signed between the operator as the entrepreneur or termed Mudarib who is entrusted with managing the takaful business and the participants as the provider of capital called sahib al-mal who is obliged to pay the takaful contribution as the capital or rabb al-mal.

2 2011 37 54. It is also called tijari model as it works on commercial business basis. First the Takaful insurance is relatively young and not all jurisdictions in which the insurers operate have fully introduced operations related to corporate governance and needs more liquid and diversified investment choices Abdul kader et al.

This model is applicable for both general Takaful and family Takaful with minor variation. Takaful Waqf Model. Australian Journal of Business and Management Research 18 2328.

Takaful Rules 2012 is the basic law that governs the functions and conduct of Takaful companies as well as for Takaful window operations. Keeping in mind the uncertainties of COVID-19 we are continuously tracking and evaluating the direct as well as the indirect influence of the pandemic. Many models such as the Wakalah model Mudharabah model and the amalgamation of Mudharabah and Wakalah models have been applied in the Takaful corporate operation.

There are many unique features that the owners of policy will enjoy. International Journal of Business and Society Vol. Operational model of the takaful operator shall define its relationship with and fiduciary duties towards the participants.

Conceptual and Operational Differences Between General Takaful and Conventional Insurance. However the most widely used models are mudharaba wakala and the hybrid model. Takaful Hybrid Model.

2 basic Taawuni Model Al-Mudharabah model is a profit-and-loss sharing model in which the participant and TO share the surplus. The global takaful market reached a value of US 276 Billion in 2020. A and Amin Hanudin.

Takaful Operators - Bank Negara Malaysia. Mudharaba Figure 1 is known as the profit-sharing model. Takaful is the protection plan that is based on the concepts of Shariah.

List of Licensed Financial Institutions. There are various models of takaful according to the nature of the relationship between the company and the participants. Takaful Malaysias business model was founded on the requirements and practices of Shariah.

The shareholders share in the profit or loss with the policyholder. The takaful operator shall ensure that the operational model adopted is endorsed by its Shariah Committee and Board of Directors Board. Under takaful people and companies concerned about hazards make regular contributions to be reimbursed or repaid to members in the event of loss and managed on their behalf by a takaful operator.

Shariah-Compliant Structures for a Deposit Insurance Scheme. It will provide the coverage according to the Islamic rules and regulation. Pp4-6 where participants provide capital in the form of contribution and Takāful operator acts as a mudarib who provides his management expertise to efficiently utilize the Takāful fund.

Looking forward IMARC Group expects the market to grow at a CAGR of around 11 during 2021-2026. The Hybrid-Takaful business model applies a Wakalah agent based contract for underwriting activities and Mudharabah profit sharing contract for investment activities. In Takāful Mudhārabah model is a profit sharing contract Billah 2004.

82 All takaful operators are required to document the operational model to be. This model allows Takaful Malaysia to employ the agency system effectively in distributing the Takaful products on sound commercial values and provide sufficient remuneration that commensurate with the services rendered. Like other Islamic finance products Takaful is grounded in Islamic Muamalat.

Takaful Scheme system based on Islamic Law Shariah which combines the concept of co-operation protection and responsibility and implemented together. Other business models such as Waqf model Tabarru model and combination of models are also adopted by some Takaful operators on a slighter extent. There will be no interest rate and the.

Takaful Business Models A Review A Comparison Semantic Scholar

2 Example Of Mudarabah Takaful Model Source Engku Rabiah Hassan Download Scientific Diagram

Takaful Industry In Pakistan Gcc Malaysia Growth Challenges Futu

Pdf Employing Takaful Islamic Banking Through State Of The Art Blockchain A Case Study Semantic Scholar

Jrfm Free Full Text A Nontechnical Guide On Optimal Incentives For Islamic Insurance Operators Html

Pdf An Analysis Of Islamic Takaful Insurance A Cooperative Insurance Mechanism Semantic Scholar

Takaful And Conventional Insurance A Comparative Study Professor Dr Muhammad Ridhwan Ab Aziz Academia Edu

Pdf Takaful Models Origin Progression And Future

Takaful Mudarabah Model Islamicbanker Com Investing Management Model

2 Dea Technical Efficiency Trend Of Takaful And Insurance Industry Download Scientific Diagram

Doc Regulatory Framework In Takaful This Project Paper Is A Partial Fulfillment Of Module Tk 1003 Takaful And Actuarial Practices Of Part 2 Of Certified Islamic Finance Professional Cifp Hasan Farid Academia Edu

Cost Efficiency And Board Composition Under Different Takaful Insurance Business Models Sciencedirect

Pdf Takaful An Innovative Approach To Insurance And Islamic Finance Semantic Scholar

Posting Komentar untuk "2 Models Operating In Takaful Business"